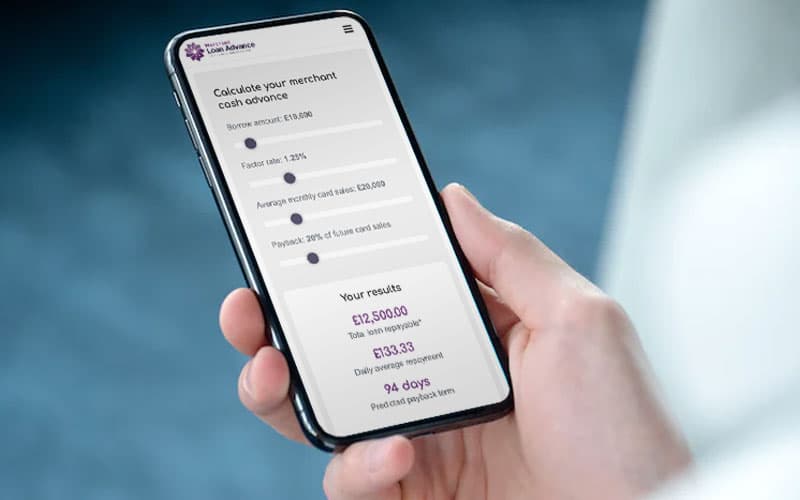

A merchant cash advance loan calculator helps you understand the figures behind the product. As with any alternative business loan product on the market, it’s good to understand not only how they work but what it means in financial terms for your business.

Calculate your merchant cash advance

Your results

£0

Total loan repayable*

£0

Daily average repayment

0 days

Predicted payback term

* This calculator is intended for illustration purposes only and the amount payable will vary for each business.

Without further ado, I’ll get straight into some financial scenarios which should help you calculate a typical merchant cash advance. You can use the formula to understand the product and make sure you are getting the very best deal for your business. On a side note, our whole of market application process means that you will get the very best competitive quote on the market. For now, though, read on.

Merchant Cash Advance Loan Calculator – the facts

First of all, each lender is different. They have differing unique requirements when it comes to taking on a new client.

Let’s firstly look at the eligibility criteria.

Has your business been trading long enough?

Generally, as a rule of thumb, your business should have at least three months of trading history. More importantly, a trading history that includes customer transactions via your merchant card terminal, otherwise known as a PDQ machine.

Is your business turnover enough to qualify?

This differs from lender to lender. Some lenders allow smaller monthly turnover figures such as £2500, while others only consider businesses that turnover more than £5000 plus per month.

How are merchant cash advances calculated?

Once all the eligibility criteria have been met, the lender will offer you an amount that is generally equal to your average monthly card transactions. Let’s say, for example, your business turnover £7,000 per month on card sales. Most lenders will offer you a £7,000 cash advance. Some lenders may provide slightly more than your card takings. Again this is down to many factors of your business’s financial health.

So how much does a merchant cash advance cost?

Just like any other business lender, merchant cash advance lenders have to make money. They do this by calculating the repayment by multiplying the loan amount by a ‘factor rate’.

What is a factor rate?

A factor rate is a figure that equates to a percentage. Let’s take the example above. Your business is eligible for a £7,000 cash advance. Lenders may offer a factor rate ranging between 1.1 to 1.5. Let’s take an example of a 1.2 factor rate. Quite simply, the loan value (£7,000) is multiplied by the factor rate (1.2), which gives a repayment value of £8,400. You should be able to use this merchant cash advance loan calculator for any quotes required.

How are the repayments calculated?

When your business makes a sale on a card, a proportion of that sale is repaid back to the lender. Let’s use an example of a 15% repayment. You make a £100 sale, and the customer pays you via your card machine. 15% of the sale (£15) is repaid off your merchant cash advance back to the lender – usually in realtime via the card processor.

If your business makes cash sales, these are generally not considered – only a proportion of your card sales are repaid.

What other charges could there be?

The lender will stipulate that there are no other hidden charges or fees (because there shouldn’t be any). It’s good to check and confirm with them at the point of your quote.

Merchant Cash Advance Companies List

A good source of information is the BMCAA website – The British Merchant Cash Advance Association for short! The site has an updated list of lenders, and you can apply through the BMCAA to access a quote from all lenders in one easy application.

Merchant Cash Advances via a broker

Unlike other brokerages, we don’t charge any fees to customers seeking a merchant cash advance. Instead, we are paid a commission by the lender ‘if’ the client successfully receives funding.

“We help many businesses every single day find the funding they need – from Garden Centres requiring £200,000 to cafes requiring £3000. We mainly see funding requests for restaurants and retail shops generally requiring £20,000 or £30,000 – but we’re happy to help any size of business.

"We know what a good deal for the customer is, and we make sure they get the best deal available in the market. We’ve been in the business cash advance sector since 2013 and have built up a large, loyal customer base.”

Rich Wilcock from Merchant Loan Advance